Forums › Other Topics › Financial › Biolase Investment

- This topic is empty.

-

AuthorPosts

-

Glenn van AsSpectatorHi Ron…….here is my take from talking to people in several companies.

It is not uncommon for companies to push hard to drive the stock up and then the principals (CEO, VP and many in the marketing area) bail out and a company buys them.

Several ways to drive the stock up and that is sales and marketing and getting users to buy the stock to create excitement.

I think that Biolase stock has risen in recent times to 11 dollars or so from 6-8 dollars at around Xmas.

Keith told me the stock was really doing well……….is the push on now…….

Who knows but I wont post my reply back to Eldar because some things were honest and heartfelt.

I was concerned regarding what some university dentist had told him was that the Waterlase was the only laser not to cook the pulp. The competitors apparently cooked the pulp……..god was I mad.

Opusdent doesnt do that, Hoya doesnt do that.

Where is the evidence based dentistry on this.

He didnt tell me who the person was but that they were affiliated with a university and owned a Biolase.

I do hope that the financial guys get the real goods and not some feel good story………

Thanks for posting Ron……..interesting thread.

Oh RAY…….OH BOB , where are you??

Glenn

Robert GreggParticipantOh Man!

What a topic!

It’s 1991 all over again (remember I’ve been saying it’s 1990 all over again). We’re moving closer to the next Armagedon of laser dentistry.

In 1991, when ADL went public with an IPO and for the next couple of years, Tom Chess, Kim Kutsch, Del, I and others received regular calls from analysts like this.

They started paying attention because of the IPO “road show” and PR and trade advertising that ADL was putting on that was just enormous. When ADL went public, the underwriter hype went along with it, driving the share price up. We got more calls. We invested. Tom and Kim bought low and sold high–made good money. I broke even!

We gave our best and honest answers–like Ron has done. Thoughtful, fair and measured. The responses were always appreciated. But we all missed the point.

1. Impulse buying of ADL dLase 300 in 1990 and 1991 led to some dissatisfied customers with buyer’s remorse.

2. Claims were made that couldn’t be replicated by anyone but the Guru’s.

3. Company provided training was non-existant. It was left to dentist trainers to train in their offices, similar to today (so the ALD was formalized)

4. Standardization of claims and procedures was lacking–even FDA clearance in many cases (so the curiculum Guidelines were established)

5. None of this assuaged the disgruntled, untrained laser dentists with โ,000 laser that they didn’t know how to use–or couldn’t use or integrate into the practice effectively.:angry:

6. Most lasers became plant stands.

7. Some dentists were a little bit more angry.:angry:

They filed a class action lawsuit alleging over-stated claims by the salespeople and paid “Clinical Instructors” (sales seminar dentists), fraud and a few other things.

They filed a class action lawsuit alleging over-stated claims by the salespeople and paid “Clinical Instructors” (sales seminar dentists), fraud and a few other things.The stock of the high rising ADL plumeted. Went from ฝ to ū in just a few months–never recovered.

Today ADL/ADT (ADLI) trades at 28 cents a share– a far cry from their IPO of ฝ.00.

Hype without substance. Claims without science. Procedures without protocols. That’s the unfortunate legacy of ADL/ADT. (And ADL had a reliable, durable, stable laser device and deliver system still in use by many of us today.)

And we stopped getting calls from analysts…..

………and now they’re baaaaaack!

Hold on to your check books ladies and gentlemen. Beware: stock prices rise before they fall.:o

Bob

ASISpectatorHi All,

Interesting read.

History does repeat itself.

A person who doesn’t know history is bound to repeat it.

Andrew

lagunabbSpectatorThe Abacus venture that I am familiar with is run out of Hong Kong. I don’t know much about Abacus here in the US. My guess is that it’s a small hedge fund that could either go short or long, or perhaps already have either a short or long position. If the fund has no position, it’s a strange start to doing research as I would assume someone on staff or by contract has some rudimentary understanding of laser physics. If the fund has a long position, the questions are starting at the wrong spot with questionable timing. If the fund is short, they are stuck with a losing position and are grabbing at straws to extricate themselves from a bad position using whatever means available. (there has been a sharp increas in short-interest since Feb and I am guessing the average breakeven price for the shorts is at least 20% lower than where the stock is trading now) Take your pick but I would not take the questions too seriously until more information is provided. Having said that, I do believe a shoot-out would be useful for current-generation systems. The only thing that’s come close to a shoot-out was a report by Stewart Rosenberg that compared cutting of extracted teeth at a convention.

PS. Being a money manager or an analyst can be a lonely route, sometimes very lonely. The lonely route is the often the right route.

AnonymousGuestAnd today (5/1/03), another one……

Dr. Schalter,

I recently sent a letter to your attention introducing myself and the idea

of an investment in Biolase. I would like to discuss this with you further

at your convenience. I will be brief. We have visited the company and done

other extensive analysis that you might find interesting as well.All the best,

Joshua Gimpelson

Financial Consultant

Oppenheimer and Co

888-336-9787

joshua.gimpelson@us.cibc.comP.S. We have a research report available on Biolase. If you are interested

in receiving this report, please reply via email or phone at the above

number.Information in this message reflects current market conditions and is subject to change without notice. It is

believed to be reliable, but is not guaranteed for accuracy or completeness. Details provided do not supersede your

normal trade confirmations or statements. Any product is subject to prior sale. Oppenheimer & Co. a Division of

Fahnestock & Co. Inc., its affiliated companies, and their officers or employees, may have a position in or make a

market in any security described above, and may act as an investment banker or advisor to such. Any securities

products recommended, purchased, or sold in any client accounts will be subject to risks, including possible loss

of principal invested.

Love this part of the disclaimer-QUOTEIt is believed to be reliable, but is not guaranteed for accuracy or completeness.

lagunabbSpectatorThe best report I have seen on Biolase was the original report written by Alex Arrow now at Lazard. We compared notes on Biolase and Lumenis a while back when he first started looking Biolase. I will take credit for warning him off of Lumenis. Let me know if you are interested in his report. On the whole I find most of the sell side reports to be a little light on risks assessments. Alex’s report was well balanced.

AnonymousGuest#Moderation Mode

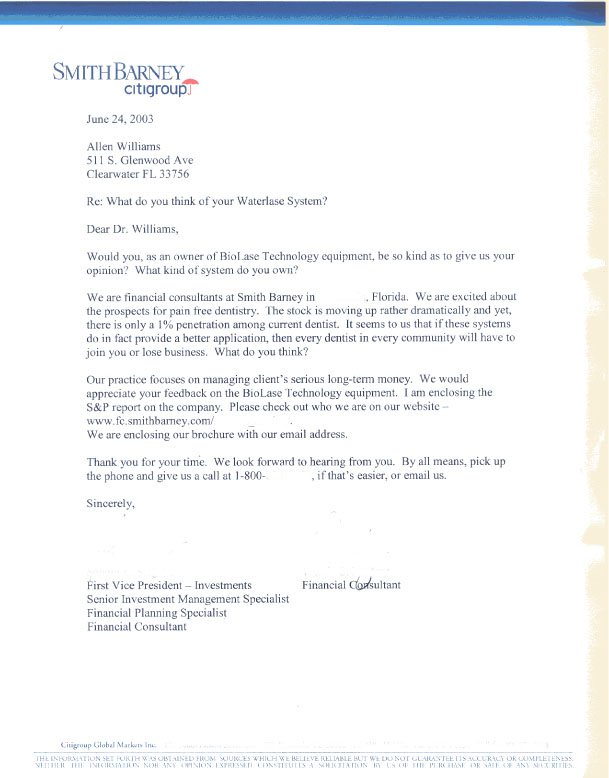

SwpmnSpectatorLetter I received last week:

Al

dkimmelSpectatorAllen, I got the very same letter from their office in Pensascola.

David

Robert Gregg DDSSpectatorTell them you’d be happy to advise them….and that your hourly fees are very reasonable.

Bob

AlbodmdSpectatorI was just contacted by an analyst from Smith-Barney in New York. So how much is a good hourly rate to charge for my consulting? 😉 Big concern seems to be the growth rate of lasers in dentistry. I don’t seem them being incorporated on a widescale quickly unless the price drops a lot. In which case, I’ll be unhappy cuz I paid so much :-(. But I can always say I was the first to have it in town!

Regards,

Al B

SwpmnSpectatorWell which one did they contact you about the DELight or the Waterlase or was it just erbiums in general???

If you believe all the crap being posted on Dental Town “comparing erbium lasers” you and me are gonna be out of luck!!!! The sky is falling, the sky is falling.

Al

AlbodmdSpectatorThey were actually asking about the Waterlase and why I picked the Delight. They wanted to know how fast I thought the market for hard tissue lasers would grow. Like I said before, not to fast unless there’s a big price drop. I don’t know how fast waterlase is telling them they think it’s going to grow. Can’t wait to see those references from Stu about how much faster the Waterlase is than the Delight. 🙂

crowboySpectatorBiolase was issued a patent today

<a href="http://patft.uspto.gov/netacgi/nph-Parser?Sect1=PTO2&Sect2=HITOFF&u=/netahtml/search-adv.htm&r=1&p=1&f=G&l=50&d=ptxt&S1=biolase&OS=biolase&RS=biolaseComments?

(Edited” target=”_blank”>http://patft.uspto.gov/netacgi….(Edited by crowboy at 4:16 pm on Aug. 26, 2003)

Glenn van AsSpectatorI see the name has changed to electromagnetic cutting, so lets see how this is different.

WIll the atomized water particles now cut metal and amalgam?

Glenn

-

AuthorPosts